IRS Instruction 1040 Line 51 2011-2026 free printable template

Show details

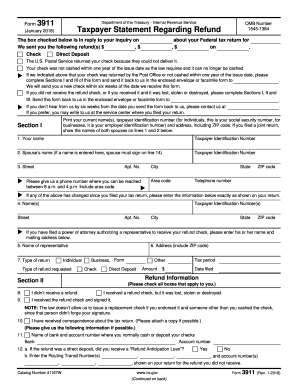

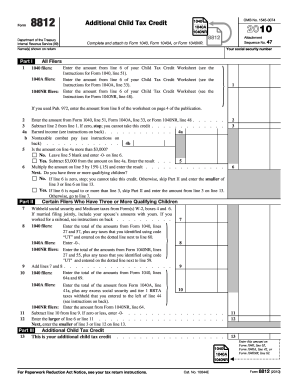

Page 40 of 102 of Instructions 1040 11:35 11-AUG-2011 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. 2011 Form 1040 Line

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign credit limit worksheet a 2024 pdf form

Edit your credit limit worksheet a irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit limit worksheet a 2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax credit 37 taxpayers qualify simple form 1040 returns schedules except earned income child student edition online

Follow the steps below to benefit from a competent PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit where can i get a child tax credit form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs credit limit worksheet form

How to fill out IRS Instruction 1040 Line 51

01

Obtain a copy of IRS Form 1040 and the accompanying instructions.

02

Locate Line 51 on Form 1040, which is designated for reporting certain types of credits.

03

Review the instructions for Line 51 to determine if you qualify for any credits.

04

Gather required documentation and information relevant to the credits you're claiming.

05

Fill out the necessary information directly on Line 51.

06

Double-check your entries for accuracy to ensure compliance with IRS guidelines.

07

Complete the rest of your tax return and prepare for submission.

Who needs IRS Instruction 1040 Line 51?

01

Individuals who are filing their federal income tax returns using IRS Form 1040.

02

Taxpayers who qualify for specific credits related to their income, dependent status, or other criteria.

03

Anyone who seeks to optimize their tax refund through applicable credits.

Fill

form 15110

: Try Risk Free

People Also Ask about credit limit worksheet a

What is the income cut off for Canada child tax Benefit?

The CDB provides up to $2,985 per year ($248.75 per month) for each child eligible for the DTC. The CDB starts being reduced when the adjusted family net income (AFNI) is greater than $71,060.

Does everyone qualify for Canada Child Benefit?

A high income may prevent you from qualifying for the CCB. Good to know: Your adjusted family net income (AFNI) is your family net income minus all Universal Child Care Benefits (UCCB) and Registered Disability Savings Plan (RDSP) benefits, plus any refunds from the UCCB or RDSP.

Where do you enter child benefit on tax return?

Note: Line 11700 was line 117 before tax year 2019. You must report the UCCB lump-sum payment that you received in 2022 for prior tax years.

Which parent should claim child on taxes Canada?

If you make child support payments for a child and the other parent does not, you cannot claim an amount for an eligible dependant for that child. Only the parent who does not pay child support can claim the amount for an eligible dependant on line 30400 of their tax return (Step 5 – Federal tax) for that child.

How to fill status in Canada and income information for the Canada child Benefits application?

You need to include the date where you or your spouse or common-law partner either: Became a resident of Canada. Became a non-resident of Canada. Became a resident of Canada again. Entered the Canadian province or territory where you resided before you left Canada.

What is the cut off for child tax Credit Canada?

For children aged 6-17 years of age, families in that same income bracket can receive a maximum of $5,903 ($491.91 every month) per child per year. These amounts will be reduced of your adjusted family net income exceeds $32,797.

Fill out your IRS Instruction 1040 Line 51 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Child Tax Credit 2025 Form is not the form you're looking for?Search for another form here.

Keywords relevant to child tax credit worksheet

Related to i need to do my 2023 taxes

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.